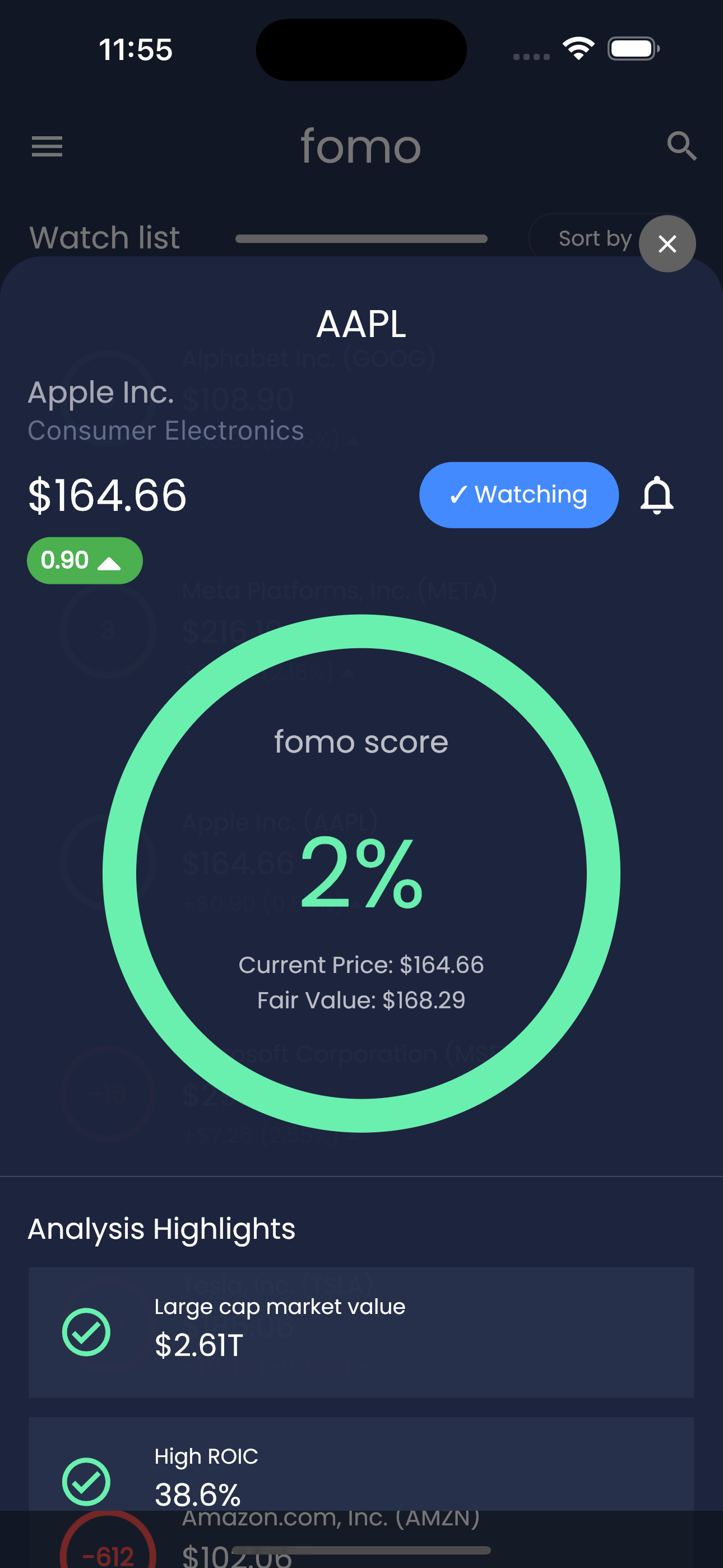

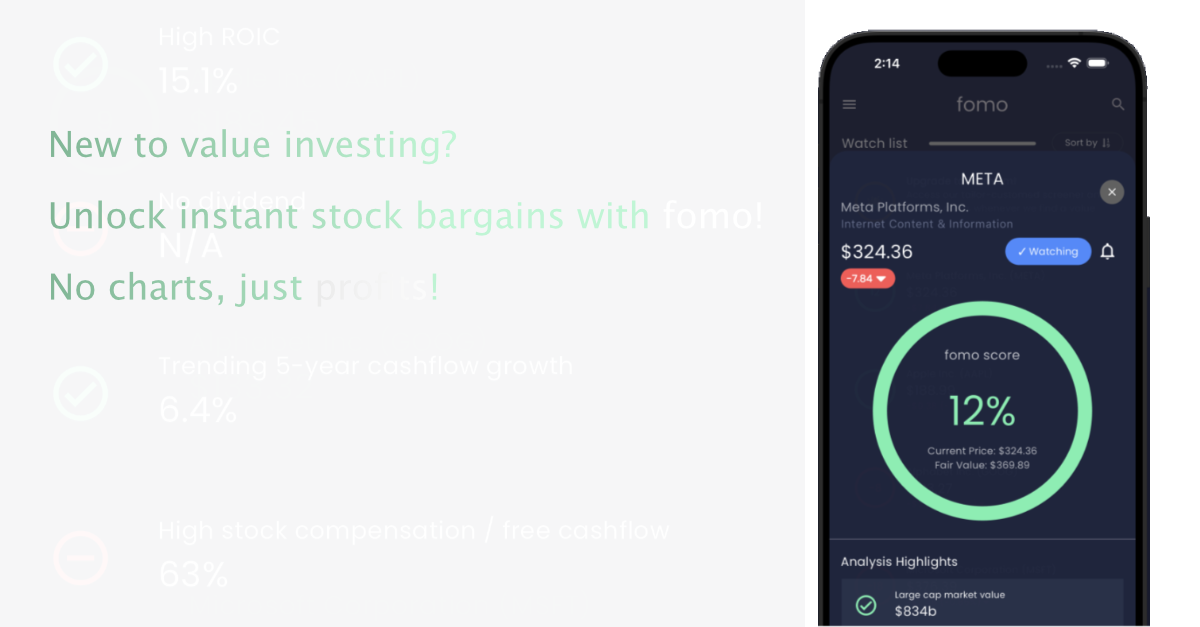

A powerful suite for value investors

Get instant valuations and fundamental analysis highlights of all your favorite stocks. Forget charts, data tables, and transcripts.

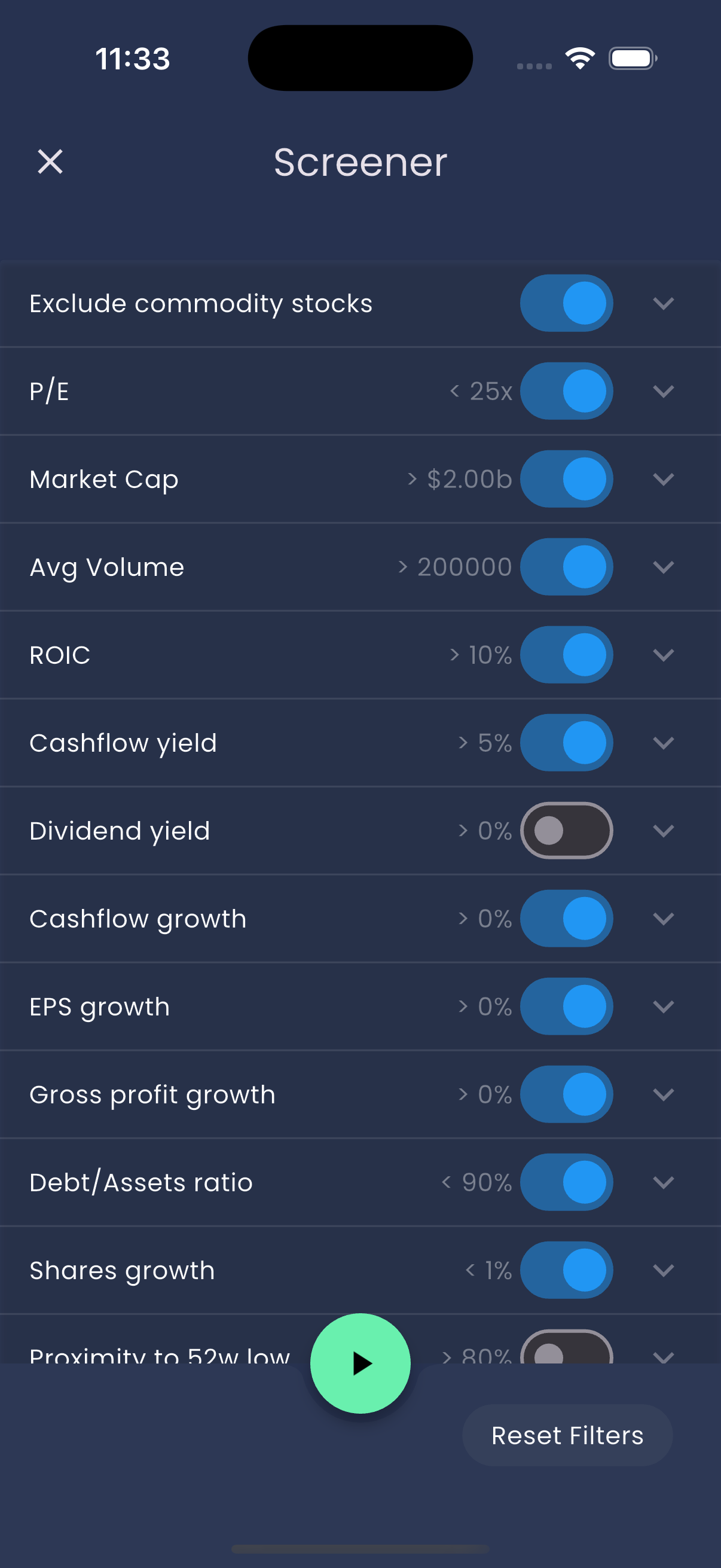

Screening doesn't have to be complicated

Use the built-in screener tool to find the highest-scoring companies, or wait for the screener to alert you whenever it finds a value-play!

Perfect tool

FAQs

How do I interpret the fomo score?

A higher score indicates that the stock is being offered at a more significant discount when compared to its fair market value. A score above 30% is considered to have a reasonable bargain. A negative score indicates the stock is likely trading at a higher price than its fair value.

How is the fomo score calculated?

The algorithm primarily calculates Discounted Cashflow Value (DCV) based on EPS. However, instead of relying on analyst estimates, the software uses linear regression (trendlines) and historical averages from annual income statements to estimate future performance. Other variables, such as a company's Return on Investment Capital (ROIC), are also factored into the score.

How accurate is the fomo score?

Results vary depending on the completeness and accuracy of the financial data it consumes. The score is purely mathematical and doesn't involve human analysis. Generally speaking, calculating intrinsic value is far from an exact science. A value investor analyzes a company's history to try and make an educated guess about its future. No two investors will calculate intrinsic value similarly or make the same assumptions about a company. Instead of trying to predict the future accurately, value investors ensure that their assumptions are conservative to compensate for unknowns or unforeseeable events. We call this Margin of Safety.

Are you a professional investor or advisor?

No one on our team is a financial advisor, analyst, or institutional investor. We make no recommendations and do not provide financial advice in any form.

What makes fomo so different from other tools?

Many books, podcasts, and websites offer ways to calculate a company's fair value. Unfortunately, many of these methods require you to do homework beforehand and provide assumptions for an estimated value. You need to repeat this process for every company on your radar. Screeners can help narrow the playing field by filtering stocks by comparing key metrics, but in most cases, you still have to analyze the results manually. In addition, some services are expensive or overwhelm you with too much data. With Fomo in your toolkit, you'll be able to spot great buying opportunities within seconds!

Are all publicly traded companies available?

No. Many companies do not provide sufficient data to plug into the algorithm. Several international companies, recent IPOs, and OTC/penny stocks fall into this category. We require at least ten years' worth of financial data. We will only score companies that meet this criterion, although partial analysis highlights may be available whenever possible.

Is price data in real-time?

No. Price data is delayed 15 minutes.

Should I buy a stock only because it has a high fomo score?

Definitely not. Fomo uses a custom algorithm that depends on the raw financial data, which sometimes may be inaccurate or incomplete. Furthermore, a company's balance sheet and income statement may not tell you everything you need to know about the story of a company. In conclusion, you should only use it as a screener. If the score looks attractive, take it to mean that further research is warranted before deciding to enter a position.